What is an Electoral Bond

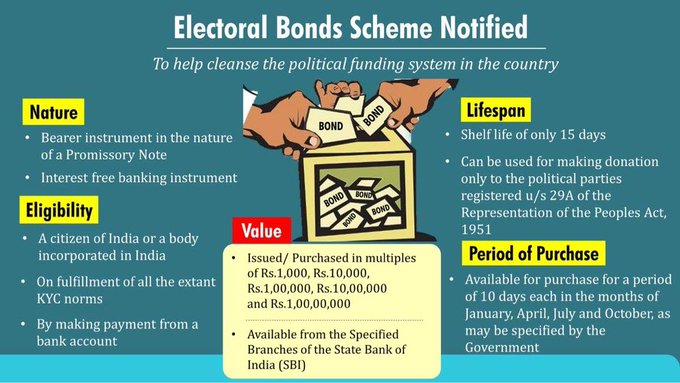

An electoral bond is a promissory note that can be purchased by any Indian citizen or company incorporated in India from select branches of the State Bank of India. Thereafter, the citizen or corporate can donate to any eligible political party of their choice. Electoral Bonds are similar to bank notes that are payable on demand to the holder and are free of interest. Any person or party will be allowed to buy these bonds digitally or through cheque.

Electoral bond introduced

Electoral bonds were introduced with the Finance Bill (2017). On January 29, 2018, the Narendra Modi-led NDA government notified the Electoral Bond Scheme 2018.

How to use electoral bonds?

Using Electoral Bonds is quite simple. The bonds will be issued in multiples of Rs 1,000, Rs 10,000, Rs 100,000 and Rs 1 crore (Bonds range from Rs 1,000 to Rs 1 crore). These will be available at some SBI branches. A donor having a KYC-compliant account can purchase the bonds and then donate them to a party or individual of his/her choice. Now, the bond can be encashed through the verified account of the receiving party.

The Electoral Bond will be valid for fifteen days only.

Conditions for Electoral bonds

- Any party which is registered under section 29A of the Representation of the People Act, 1951 (43 of 1951) and which has secured at least one per cent of the votes polled in the most recent general elections or assembly elections, is eligible to receive electoral bonds .

- The party will be allotted a verified account by the Election Commission of India (ECI) and electoral bond transactions can be done only through this account.

- The name of the donor will not be there on the electoral bond. Thus, the political party may not be aware of the identity of the donor.

Controversy over Electoral Bond

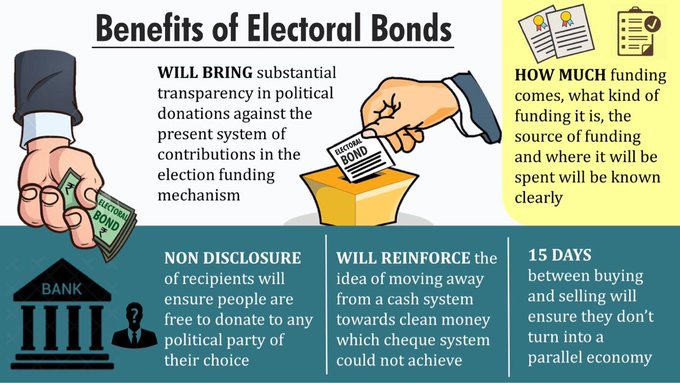

Experts and many politicians say that since neither the political party purchasing the bond nor the political party receiving the donation is required to disclose the identity of the donor, the corporation’s shareholders will remain unaware of the company’s contributions. Voters will also have no idea as to how and through whom a political party has been funded.

Opponents of the Electoral Bonds scheme argue that since the identity of the donor is kept anonymous, it can lead to inflow of black money. Some others allege that the scheme was designed to help big corporate houses donate money without revealing their identity. According to civil rights committees, the concept of donor “anonymity” threatens the very spirit of democracy.

Restrictions that were removed after the Electoral Bond Scheme was launched

- Earlier, under the Companies Act, no foreign company could donate to any political party.

- As per Section 182 of the Companies Act, a firm can donate a maximum of 7.5 per cent of its average three-year net profit to political charity.

- As per the same section of the Act, companies were required to disclose the details of their political donations in their annual statement of accounts.